Defending yourself against fraudulent collection letters from abroad

Time and again, debt collectors try to push the boundaries of what is legally permissible, for example by charging excessive fees.

There are also fraudsters who hire debt collectors to collect fictitious debts or send fake debt collection letters themselves.

It is not uncommon for these scammers to operate from other European countries.

We explain how to spot fake letters and what to do about them.

Most private individuals have never had to deal with a court in their lives. And they very rarely receive a reminder. This is why most of them are shocked and frightened when they receive a reminder.

Unscrupulous companies take advantage of this situation to enforce legally dubious or even unfounded claims against consumers. The use of debt collectors - and sometimes lawyers - puts massive pressure on victims in order to profit from their helplessness or desperation.

It can happen that companies from other EU countries have their debts collected by German debt collection agencies, but foreign debt collection agencies are also active on the German market.

Criteria for dubious debt collection letters

The most important thing is to keep a cool head. If you think that the payment requested is not justified, you should first check the seriousness of the letter or the debt collection agency or lawyer.

The following criteria may indicate fraudulent activity

- Insufficient or false information

Some scammers pretend to be debt collectors using fictitious names. Others try to imitate real debt collectors.

Search the internet to see if you can find information and warnings about the debt collection agency. If the debt collection agency does exist, check whether there are any obvious discrepancies between the letter and the official appearance of the company on the internet, such as a wrong telephone number.

Reminders must also be written in a way that makes it clear who is asking for money and why.

- Poor spelling and grammar

Reputable debt collectors also take care to communicate professionally with the debtor. However, frequent typing errors, poor spelling or grammatical mistakes may indicate dishonest intentions.

- Reminders sent only by email or SMS

Reminders that only reach you as an informal email or text message are a strong indication of a scam. Legitimate debt collectors will also send emails, but these will either contain a professional reminder letter as an attachment, or the reminder letter will also be sent by post.

- Debt collectors operating from abroad

Scammers often operate from abroad. If the debt collection letter contains a foreign address, telephone number or bank account, be extra careful. You can recognise foreign telephone numbers by the corresponding country code (e.g. + 43 for Austria) and foreign bank details by the corresponding IBAN country code (e.g. ES for Spain).

- No entry in the Legal Services Register

Reputable debt collection companies in Germany are registered with the "Rechtsdienstleistungsregister" or with the "Rechtsanwaltskammer" if they are lawyers.

It is important not to confuse these registers with the commercial register. An entry in the commercial register alone is not sufficient.

To check the registration of a debt collection agency

On the Legal Services Register website, click on 'Find registration'. As the registration number is often not given in the debt collection letters, enter the name of the debt collection agency in the 'Name/Firma' column. Make sure you spell it correctly.

In the case of genuine debt collection agencies, you will then receive a hit with the file number and the competent registration authority.

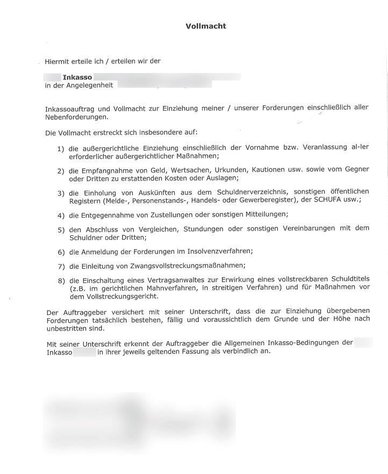

Another sign of attempted fraud – lack of power of attorney

It is also important to check whether the debt collection agency or lawyer has actually been instructed to send you a reminder for the third party debt. Simply stating that they have been instructed to do so does not meet the legal requirements.

Instead, proof must be provided in the form of a written power of attorney that also identifies the issuer with a legible signature.

This written authorisation must be submitted as an original.

You can reject a photocopy or a "certified copy" by a lawyer as insufficient. Similarly, it is not enough for the solicitor to "certify that it has been duly authorised by a solicitor".

For example, your first (and possibly only) letter to the other side could be worded as follows

"You have not properly proved your authority and have not provided me with an original written power of attorney that includes the name of the issuer. For this reason alone, I reject your letter".

It is astonishing how often the question of power of attorney is the end of the matter, because it is too much trouble for the debt collectors, who are probably more interested in making a quick buck.

Free help

The free debt collection check from the Consumer Centres can help you check whether a letter is bona fide or whether the amount of the debt collection costs is justified.

If you have any doubts, the lawyers at the European Consumer Centre (ECC) Germany can help you free of charge with debt collection letters from other EU countries. Go to the online form.

FAQ: Recognising and responding to fraudulent debt collection letters

What are debt collectors?

Debt collectors are nothing more than commercial debt collectors. They are paid by their clients to collect money.

What can debt collectors do?

Even if debt collectors give the impression that they can attach an account or send a bailiff after a debtor, they are not allowed to do this. To do so, they would first need a legally binding court order.

Before legal action is taken, debtors can only be asked to pay without the claim being enforced.

In the case of justified claims, however, a Schufa entry may be threatened after two reminders. To avoid this, unjustified claims must be contested in writing. See below for more information on disputing claims.

Do I have to pay the debt collection agency's fees?

When a debt collection procedure is initiated, there are of course costs associated with the work of the debt collection agency. These can be passed on to the debtor under certain conditions. In particular, the involvement of the debt collection agency must be justified and the costs charged must not exceed the narrow legal framework for such fees.

The admissible costs for a reminder do not usually exceed €2 to €3. Debtors often also charge interest on arrears, the period and amount of which must be stated.

It is not uncommon for imaginary fees to be charged, far in excess of what is permitted by law. These excessive fees do not have to be paid, even if the original claim was justified.

If it is clear that you have no contractual relationship with the debt collector, you do not have to pay anything.

I have fallen into a subscription trap and am receiving debt collection letters. How do I get out?

The first step if you have fallen into a subscription trap is to dispute the unjustified claim.

Unfortunately, contesting does not always bring peace of mind. Dodgy debt collectors will continue to send you reminders. Some debt collection agencies also threaten to make a “Schufa” entry. We explain all this in the following sections.

How can I dispute a debt collection letter?

There can be many reasons for objecting to debt collection letters. For this reason, there is no generally applicable sample letter.

In the VZ debt collection check, there is a generator that distinguishes between different situations and, depending on the situation, creates a sample letter that you can send to the debt collector to dispute the debt.

If you have doubts about the integrity of the debt collector, you should be very careful not to provide any personal information that goes beyond what the debt collector already has about you. For example, if the debt collector does not already have your telephone number, you should not give it out when you dispute the debt.

If the reminder is clearly fraudulent (e.g. from someone on the VZ blacklist), it is better not to respond at all. Any contact would only encourage the scammers to send more reminders. Instead, a report should be made to the police. The perpetrators may be prosecuted for fraud or extortion.

What should I do if I continue to receive reminders?

If you have familiarised yourself with the law and are sure that the claim is unjustified, and you have also told the other party that you refuse to pay, you can safely ignore further reminders.

Waves of reminders are a targeted attrition tactic. They are often accompanied by the threat of legal action. You don't have to go there. It would be a waste of effort anyway. They are not interested in your opinion, they are interested in your money.

Don't agree to pay in instalments or make a small deposit, even if it sounds attractive at first. Accepting such an offer can make you legally liable to pay, even if the original claim turns out to be unfounded.

The debt collector is threatening to report me to Schufa*. What can I do?

Subscription trap operators or debt collectors often threaten to make a Schufa entry to underline their demands. Don't be fooled. There is no truth in this threat for several reasons.

On the one hand, the Schufa works exclusively for its members and it can be assumed that operators of subscription traps, for example, do not belong to this group.

In addition, according to data protection regulations, the transmission of personal data is only permitted with the customer's prior consent. What is crucial is that passing on your data is prohibited if you have objected to unauthorized use.

In the case of legitimate claims, however, a negative Schufa entry can be made after two reminders.

*SCHUFA Holding AG is a company that acts as a central repository of information about you (the consumer) from utilities, banks, internet providers and more.

The company tracks all bills or fines over time. Using this raw data and analysing it through their own algorithm, they create and record a credit score for all German residents.

To the Schufa website

This must be taken seriously: The order for payment and the judicial order for payment procedure

If a court order has been issued against you, you must take action. It would be more than reckless to simply ignore the court order. However, some debt collection agencies also try to confuse you in this context. Therefore, you should know the following about the legal dunning procedure and what happens next.

A payment order is issued by a court. This is a form filled in by the other party and sent to you by the court without any detailed legal examination. The service of the order for payment does not mean that the claim is justified. After all, a bailiff at the court has only checked that the order for payment form has been filled in correctly.

You should read the documents sent by the court with the order for payment very carefully, seek further legal advice and decide whether you wish to lodge an objection.

The legal deadline for this is 14 days. In the case of a European order for payment, the deadline is 30 days.

Funded by the European Union. Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union or the European Innovation Council and Small and Medium-sized Enterprises Executive Agency (EISMEA). Neither the European Union nor the granting authority can be held responsible for them.